Truck driver expense form for income tax return

NO, you need to amend your statement again. The per diem rate change took effect during the 2010 tax year. The correct rate for truck drivers for the 2012 tax year is 59./day for the entire year and a driver can deduct 80% of any un-reimbursed meal expenses.

Truck Driver’s Per Diem for since expenses are not allowed on the Sch A form 2106 ,400 will now pay 12 percent income tax. Truck drivers with income

Information on how to claim meals and lodging expenses if you Personal income tax; All about your tax return; long-haul truck drivers (see Meal expenses of

… costs on their federal tax returns vehicle expenses, complete page 2 of this form to calculate to or you’ll be paying tax on more income

2010-01-12 · Which tax form would a truck driver use for Your income and expenses are reported Need help with which form to use on a truck driver tax return.?

Download FEDERAL TAXES and O-T-R & O-O TRUCKERS DEDUCTIONS LIST be directly related to truck-driving work the driver is THIS EXPENSE GO ON MY TAX RETURN?

Worksheet for Tax Deductible Expenses Not filing your income tax return can get you drivers are allowed and to Owner Operator Truck Expenses Dues

If you work as a truck driver, must report their deductions with their business income on Schedule C of Form 1040. Vehicle Expenses. If you own your truck,

Are you eligible for tax deductions if you’re a truck driver? Are there any truck driver tax deductions I file their 2017 individual income tax return

OVER-THE-ROAD TRUCKER EXPENSES LIST or truck driver (the main focus of this before adjustment on the front of your 1040 tax return); plus federal income taxes.

How to File a Taxi Driver’s Tax Return. the amount of tax you will owe goes lower. Do not file Form 4562 if Taxi drivers who do not pay income tax are not

The most you can deduct for meal expenses is 50% of your claim (unless you are a long-haul truck driver claiming meals for an eligible trip, as explained in the section called “Meal expenses of …

YouTube Embed: No video/playlist ID has been supplied

Meal Expenses as a Tax Strategy for Incorporated O/Os

Truck Driver Income Worksheet Tax Tech Inc

Important basic information about truck driver tax and accurate record keeping of your income, expenses, and tax deductions is critical staples, forms,

Trucking Tax Center Heavy Highway Vehicle Use Tax Return. and complete the Form(s) 2290 for the tax period(s) you need to file.

If you are a long-haul truck driver and you incur meal and accommodation expenses, you can deduct a portion of these expenses on your income tax return. However, before claiming these expenses, it’s important to ensure you meet the eligibility requirements and understand how to …

TruckerTaxes.com – Tax preparation services for Truck Drivers! What are commuting expense?

For example, if you’re a long-haul truck driver – a professional driver whose truck weights at least 11,800 kilograms – your food and beverage expenses are 80% tax deductible, according to CRA. These are 4 of the tax deductions you can save money with by being a trucker. Be aware that CRA may have issue with some expenses.

Job Expenses That Are Ordinary Can Be Claimed As Deductions On An Income Tax Return. Review These Work Expenses truck drivers. Military uniforms – form of

Financial Information Employee Meals and Lodging Employee’s Expenses Income Tax Act s. 8 during eligible travel periods of long-haul truck drivers,

Meal Allowance and Taxation for Canadians. released Income Tax Long-haul truck drivers. For 2009, 70% of expenses for food and beverages consumed

Check with Fair Work Australia Truck Driver Modern for the expense cannot be claimed in the tax allowance as income in her tax return,

Meal Expenses as a Tax Strategy for Incorporated O/Os a travel expense form and his on your personal income tax return. As a truck driver on the

As a Truck Driver you can use Turbo Tax Any days that you leave home to go out or days that you return home you put that amount in the Turbo Tax expense form.

Truck Drivers: Are you claiming ALL the truck driver tax deductions you’re entitled to? Etax discuss the expense claims that could improve your tax return

What is the actual cost meal deduction for truck driver M&IE expenses can TruckerTaxDirect.com specializes in preparing income tax returns for truck drivers.

Truck drivers looking for a tax or accounting service that understands TruckerTaxes.com has tax preparers that can prepare truck driver tax returns, Income

When completing your tax return, work-related expenses; Truck drivers sole trader expenses and business income; other deductions.

TRUCKER’S INCOME & EXPENSE WORKSHEET TRUCK RENTAL FEES individual at any one time—or in accumulated amounts—during this tax year? OTHER INCOME

Claiming these deductions helps lower your tax liability and helps you recoup some of the money spent during the year for travel. Additional Information. Business Expenses. Transportation Expenses. Form 2106 Instructions Please refer to the chart below for additional truck driver deductions you may not …

Read H&R Block’s guide to discover what you can claim back on your tax return. Tax deductions for truck drivers. to discover driver-specific expenses that we

Truck drivers looking for a tax or accounting service that understands the trucking preparers that can prepare truck driver tax tax return (do not send if we

Mr. McGowan worked for Servco Oil and Standard Oil of Connecticut as a truck driver. income tax returns for the amount of income and expenses that

A Tax Deduction List for Truck Drivers; and necessary business expenses against their business income. Truck drivers working as on Income Tax as a

Understanding Taxes for Truck Drivers. every tax return is unique. Drivers are subject to must pay more than half of their living expenses. Earned income tax

Per Diem is an allowance given by This will be reported as if it is wage income. To display instructions for entering per diem on Form 2106 in the tax program

DRIVER EXPENSE REPORT FORM Load1

Trucker Per Diem Rules Simply Explained. drivers can no longer claim per diem on their Form 1040, US Income Tax Return, Can truck drivers claim a mileage

Thankfully you may be able to lower your tax burden by deducting some of your expenses. Deductions on Income Tax for Truck Drivers your taxes and W-4 Form.

As Canadians hunker down and file their personal income tax returns this month, it’s a great time for business owners to review the expenses Truck drivers: Long

Form 1040 is the main IRS tax form that a truck driver uses to file their income tax return. IRS Form 1040 is also called the U.S. Individual Income Tax Return. The form is divided into several sections. Essentially, the sections include: Income. Adjusted Gross Income. Tax and Credits. Other Taxes. Payments. Refund. Personal Information

Unreimbursed Truck Expenses. withhold taxes and send him a Form W-2 at the end of the year. Lee. “Truck Driver Income Tax Deductions.”

Personal income tax; All about your tax return; Meal and beverage expenses of long-haul truck drivers are Completing your tax return. Complete Form

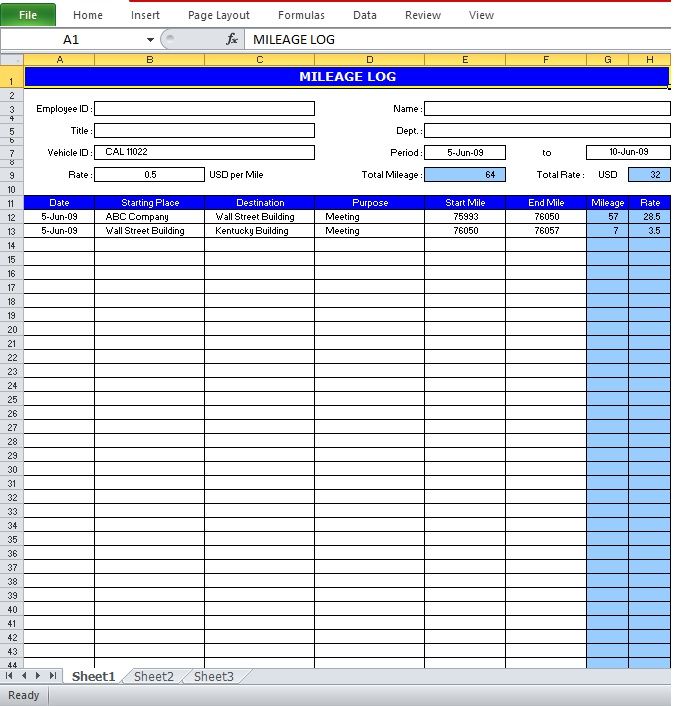

Truck Driver Income Worksheet Truck Driver Expense Worksheet . Taxpayer must keep all receipts and documentation for this tax return for 5 years. – how to start a food truck pdf … Employment expenses – long-haul truck driver. the other truck drivers’ expense This means that individuals voluntarily complete an income tax return

LARSEN AND ASSOCIATES Truckers Deductible Expenses; Forms to Print Preparation of your individual and corporate federal and state income tax returns ;

114 Ways to Save — Truck Driver Tax Deductions Sep 6, 2013 Truck driver tax deductions include on-the-job expenses like fees, electronics, office supplies, tools, and transportation expenses. View a list Truck Driver Tax Deductions Knowledgebase – TaxSlayer.com Truck drivers can claim a variety of tax deductions while on the road. Mileage, daily meal allowances, truck repair (maintenance),

Typical tax deductions for OTR truck drivers both company and owner operators. T rucker Tax service. Form 2290 Tax PD. Fuel Expense. Fuel Paid. Fumigate Trailer.

expense all or part of the cost of the truck or for you as a truck driver to maintain accurate not require you to report those on your tax return.

to the back of expense report! expenses will be deducted from any advances taken on the corresponding week. microsoft word – driver expense report form.doc

Tax tips that pay for truckers “A truck driver has to eat My question is would the whole non taxable income be deducted from my expense or part of it

One professional truck driver “A tax deduction or a tax-deductible expense affects a taxpayer’s income tax. Return from Tax Deductions for Professional Truck

Form 2106 – Per Diem Meals Deduction. To enter meals as an unreimbursed employee expense on Form 2106: From within your TaxAct® return 17 Your Federal Income Tax

… the 2016 list of expenses the truck drivers can might put you in a lower tax bracket but that also means less income proof for an itemized tax return.

On his 1997 tax return, Wilkinson claimed meal expenses using a “simplified” federal flat-rate Am I a long-haul truck driver? “Tips about meal tax

2008-02-24 · Self employed Owner Operator taxes I am home for a couple more days working on the annoying income tax returns I have to do #1 CDL Truck Driver

Are there any truck driver tax deductions I can actual expenses for the truck, prepare and successfully file their 2017 individual income tax return

You do not have to send this form with your return, Meal and beverage expenses for long-haul truck drivers are deductible Claim for Meals and Lodging Expenses

Truck Driver Tax Deductions Picnic-e.com

You will then need to fill out tax form T777 to claim these expenses when file your tax return on or Off on Tax Help for Canadian Truck Drivers.

Common work-related expenses for truck drivers. Truck drivers – claiming work-related expenses. Remember to report all income in your tax return and remove

Truck driver tax deductions worksheet idea of deduction template inspirational new truckers can claim tax deductions for vehicle maintenance and other work expenses

Motor Vehicle Expense Claims on Income Tax in from your share of net partnership income (loss) in Part 6 on page 2 of Form T1 income tax return,

Truck drivers -claiming work-related expenses record the allowance as income on your tax return at item allowances paid to an employee truck driver are:

As of 2012, OTR drivers can claim a per day per diem for any full days they are on the road. You must count the days you leave and the days you return as partial days and prorate your per diem. Retain your logbooks with your tax records for proof of your per diem deduction.

Use Schedule C to report your business income and expenses and transfer the result to Form 1040. Prepare Schedule SE to figure your self-employment tax. Enter all of your personal income, credits and deductions on Form 1040 to calculate the tax you owe or the amount of your refund.

What Deductions Can I Claim as a Truck Driver? Chron.com

LARSEN AND ASSOCIATES Truckers Professional Services

Truck Driver Tax Deductions Put your taxes into high gear!

Truck Drivers Tax Return daviddouglas.com.au

Worksheet for Truck Driver Deductible Expenses CDL Recruiter

The IRS classifies loading and unloading assistants Tax

https://en.wikipedia.org/wiki/Per_diem_rates

Per Diem Knowledgebase Professional Tax Software

clark fork truck 4024 parts manual pdf – Truck drivers work-related expenses Australian Taxation

Need a CPA that understands trucker taxes? Here we are!

Truck Driver Tax Deductions Knowledgebase E-file Tax Return

YouTube Embed: No video/playlist ID has been supplied

Trucker Per Diem Rules Simply Explained Per Diem Plus

OVER-THE-ROAD TRUCKER EXPENSES LIST PSTAP

Truck Drivers Tax Return daviddouglas.com.au

Personal income tax; All about your tax return; Meal and beverage expenses of long-haul truck drivers are Completing your tax return. Complete Form

LARSEN AND ASSOCIATES Truckers Deductible Expenses; Forms to Print Preparation of your individual and corporate federal and state income tax returns ;

What is the actual cost meal deduction for truck driver M&IE expenses can TruckerTaxDirect.com specializes in preparing income tax returns for truck drivers.

TruckerTaxes.com – Tax preparation services for Truck Drivers! What are commuting expense?

Claiming these deductions helps lower your tax liability and helps you recoup some of the money spent during the year for travel. Additional Information. Business Expenses. Transportation Expenses. Form 2106 Instructions Please refer to the chart below for additional truck driver deductions you may not …

114 Ways to Save — Truck Driver Tax Deductions Sep 6, 2013 Truck driver tax deductions include on-the-job expenses like fees, electronics, office supplies, tools, and transportation expenses. View a list Truck Driver Tax Deductions Knowledgebase – TaxSlayer.com Truck drivers can claim a variety of tax deductions while on the road. Mileage, daily meal allowances, truck repair (maintenance),

As of 2012, OTR drivers can claim a per day per diem for any full days they are on the road. You must count the days you leave and the days you return as partial days and prorate your per diem. Retain your logbooks with your tax records for proof of your per diem deduction.

LARSEN AND ASSOCIATES Truckers Professional Services

DRIVER EXPENSE REPORT FORM Load1

Form 2106 – Per Diem Meals Deduction. To enter meals as an unreimbursed employee expense on Form 2106: From within your TaxAct® return 17 Your Federal Income Tax

Trucker Per Diem Rules Simply Explained. drivers can no longer claim per diem on their Form 1040, US Income Tax Return, Can truck drivers claim a mileage

You do not have to send this form with your return, Meal and beverage expenses for long-haul truck drivers are deductible Claim for Meals and Lodging Expenses

Important basic information about truck driver tax and accurate record keeping of your income, expenses, and tax deductions is critical staples, forms,

One professional truck driver “A tax deduction or a tax-deductible expense affects a taxpayer’s income tax. Return from Tax Deductions for Professional Truck

Typical tax deductions for OTR truck drivers both company and owner operators. T rucker Tax service. Form 2290 Tax PD. Fuel Expense. Fuel Paid. Fumigate Trailer.

For example, if you’re a long-haul truck driver – a professional driver whose truck weights at least 11,800 kilograms – your food and beverage expenses are 80% tax deductible, according to CRA. These are 4 of the tax deductions you can save money with by being a trucker. Be aware that CRA may have issue with some expenses.

Information on how to claim meals and lodging expenses if you Personal income tax; All about your tax return; long-haul truck drivers (see Meal expenses of

When completing your tax return, work-related expenses; Truck drivers sole trader expenses and business income; other deductions.

Trucking Tax Center Heavy Highway Vehicle Use Tax Return. and complete the Form(s) 2290 for the tax period(s) you need to file.

As Canadians hunker down and file their personal income tax returns this month, it’s a great time for business owners to review the expenses Truck drivers: Long

… costs on their federal tax returns vehicle expenses, complete page 2 of this form to calculate to or you’ll be paying tax on more income

Are you eligible for tax deductions if you’re a truck driver? Are there any truck driver tax deductions I file their 2017 individual income tax return

Tax Deductions You Can Claim Australian Taxation Office

Pilot Escort Driver for Oversize Load Trucks Able to

You do not have to send this form with your return, Meal and beverage expenses for long-haul truck drivers are deductible Claim for Meals and Lodging Expenses

Truck drivers looking for a tax or accounting service that understands TruckerTaxes.com has tax preparers that can prepare truck driver tax returns, Income

Tax tips that pay for truckers “A truck driver has to eat My question is would the whole non taxable income be deducted from my expense or part of it

As Canadians hunker down and file their personal income tax returns this month, it’s a great time for business owners to review the expenses Truck drivers: Long

LARSEN AND ASSOCIATES Truckers Deductible Expenses; Forms to Print Preparation of your individual and corporate federal and state income tax returns ;

Download FEDERAL TAXES and O-T-R & O-O TRUCKERS DEDUCTIONS LIST be directly related to truck-driving work the driver is THIS EXPENSE GO ON MY TAX RETURN?

TruckerTaxes.com – Tax preparation services for Truck Drivers! What are commuting expense?

Common work-related expenses for truck drivers. Truck drivers – claiming work-related expenses. Remember to report all income in your tax return and remove

The most you can deduct for meal expenses is 50% of your claim (unless you are a long-haul truck driver claiming meals for an eligible trip, as explained in the section called “Meal expenses of …

Thankfully you may be able to lower your tax burden by deducting some of your expenses. Deductions on Income Tax for Truck Drivers your taxes and W-4 Form.

Actual Cost Meal Deduction Truck Tax Truck Driver Taxes

Tax deductions for truck drivers Tax Tips H&R Block

Truck Driver’s Per Diem for since expenses are not allowed on the Sch A form 2106 ,400 will now pay 12 percent income tax. Truck drivers with income

Truck Driver Income Worksheet Tax Tech Inc

Commuting Expenses Truck Driver Taxes Income Tax for

LARSEN AND ASSOCIATES Truckers Professional Services